This post is written on behalf of Chase Mortgage Banking by me. All opinions remain my own.

There I was at six months pregnant and basically homeless. Ok…that might be a little bit of a stretch, but it came pretty close. While I was pregnant with my son, I had started a new job about 200 miles away from where my husband and I were living. I was renting a room from a friend while we re-located, and my husband was closing on our other house. We were moving forward on the purchase of our new home when two days before the closing, I got a phone call. There was a problem. The lender had overlooked a minor detail that would prevent final approval on the loan. I was living out of room, we had just closed on the house we owned, and my husband and I would have nowhere to go! And…the baby would be arriving in just a few months! I was hysterical. We didn’t have time to start the process all over again, and our lender was less than helpful at finding an alternative. They basically told us we would have to find a new, cheaper house.

Thankfully, my husband is quick on his feet, and he found a way to remedy the situation which quickly allowed for loan approval, and the closing date was extended. This was a huge learning lesson, and whenever I have the chance, I tell new homebuyers to work with a reputable and reliable mortgage lender for such a major purchase like buying a house. That is why I am excited to partner with Chase Mortgage Banking during the busiest home buying season to help other buyers seamlessly transition into their new home!

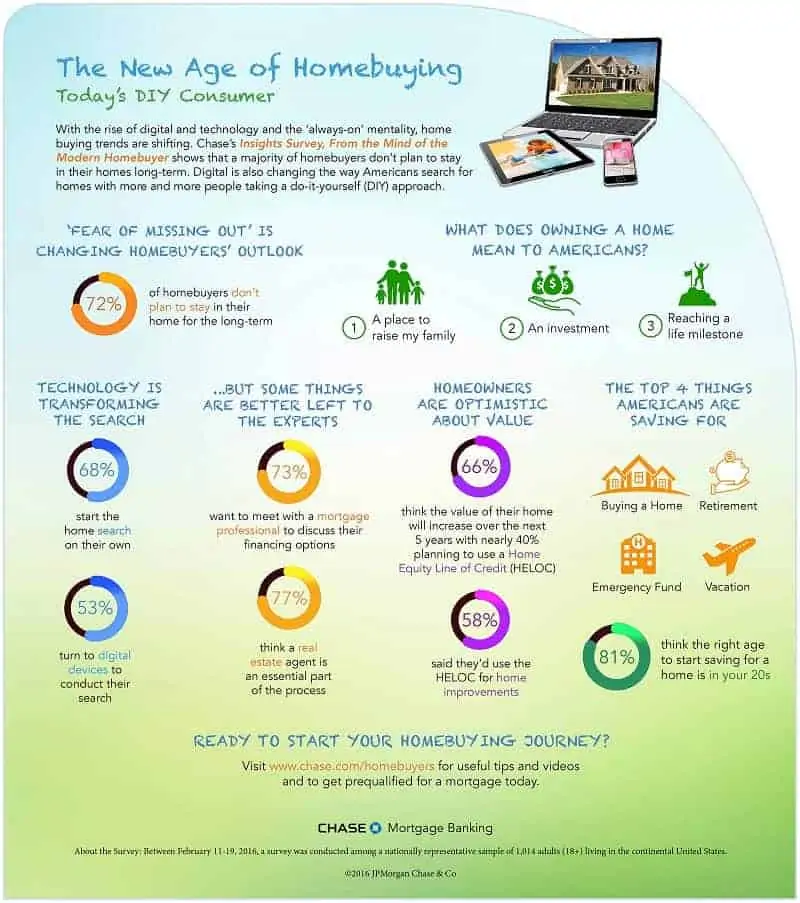

Today, the home buying process is a whole new beast, and if you don’t take advantage of new technological avenues you might miss out on the house of your dreams. In order to better serve their customers, Chase conducted an online survey aimed at discovering how the new generation is approaching the purchase of a home. They released the results of their national survey “Insights from the Mind of the Modern Homebuyer” at Chase.com/homebuyers which revealed a huge shift towards technology based applications to receive the most up to date information and easy accessibility so no listing goes unnoticed and that dream house won’t slip away. With technology constantly at our fingertips, we are “always on”. We can look for houses at anytime of the day anywhere we happen to be which it makes it more convenient than ever to shop on our time.

The survey also revealed that 72% of Americans don’t plan to stay in their homes long term. Surprising, right? However, with our fast paced world it isn’t shocking people are always looking for the next best thing. In fact, I fall into that 72% myself. My husband and I have just bought a house for the fourth time. With job changes and an expanding family our housing needs continually evolve. Eventually, we plan to build our dream home, but I am getting ahead of myself. We are always looking for the next best thing, and in the housing market, you have to move fast. Chase is there every step of the way to make the home buying process easier than ever.

Where Do You Start?

Once you decide to buy a home it can be overwhelming to take the first steps. Before you start dreaming of walk in closets and jet tubs, the first thing you need to know is how much you can afford.

At Chase.com/homebuyers you will find all the tools you need to take the first steps towards homeownership.

You can find:

- Mortgage Calculators

- Estimates on Monthly Payments

- Compare Loan terms

After you have confirmed your spending limit you can then get pre-qualified for your mortgage. Through Chase you will be paired with a local mortgage banker that will help walk you through the process and get you set up to put in an offer on that dream house. At Chase.com/homebuyers you can also find out how to get pre-qualified for your own Chase Mortgage.

House Hunting

Once you know what you can afford, you can start looking! According to the Chase survey 68% of people begin their house hunt on their own. 45% of them use their laptop or computer and 13% use their mobile phone. There are only 11% of people that check listings in print. Most people use online tools to look for houses before ever seeking help from a real estate professional. Long gone are the days of searching listings in the newspapers and spending weekends driving from house to house. Virtual tours are just a click away without having to set foot in the door.

In order to save time, and get to know what you want, it is best to search real estate sites for houses in your area. Filter your options by price, location, and number of rooms to focus only on the best houses for you. It can be overwhelming with all of the options and sites out there so it is important to know what you want and only search for what falls into your guidelines. Once you have scoured the hundreds of listings, narrow it down to the ones you want to see in person. Then, begin your work with a real estate professional to start looking at your top choice houses.

Be Realistic

Have a checklist for your potential home…but be prepared to know what you can live without on that checklist. Remember a little paint and carpet can do wonders for a house. Minor cosmetic work is manageable. You probably won’t get everything you are looking for (if you do you are very lucky!), but be thorough in your search. This is a huge commitment, and it requires time and thought. You shouldn’t feel pressured by your real estate professional, your lender or anyone else. When you have found the perfect fit, it is time to put in an offer. Your real estate professional will guide you through this process and help you determine an appropriate offer. Chase also has a Home Value Estimator!

Work with a Mortgage Professional

Once you have found the house you can’t live without, and the sellers have accepted your offer, it is time to get the process started! Since you already have your pre-qualification, you are on the right track, and you have a trusted mortgage banker to help start the loan application. 73% of Americans said they want to meet with a mortgage professional before choosing the best loan that fits their life and lending needs. Purchasing a home is a very big investment, one that can affect the rest of your life, and there are infinite lending choices. If you plan to sell later on, it can also affect your selling potential. Therefore, it is crucial to work with a lender that is helpful, knowledgeable, and there for you during such an important milestone. By choosing Chase, you will be working with a bank that has a long history dedicated to customer service. As you begin the loan process, there will be a lot of paperwork so be sure to work with a lender you can count on.

Purchasing a home shouldn’t be taken lightly, and you shouldn’t have to settle for a cut rate mortgage company. Chase will there for you during every financial stage of life and committed to making your personal finance decisions easier with helpful tools and knowledgeable staff.

Before you start your journey home visit Chase.com/homebuyers for tips and other helpful hints to apply for your mortgage.

I am happy in the home I am at. It’s modest, but we are happy here.

Thanks for sharing this. This is a great resource for anyone looking to buy a home. I love the infographic!

I love all the great mortgage tools that Chase has to offer. It’s a fantastic way to make the process so much easier.

I keep day dreaming about building a dream home or buying one but not anytime soon. Love all of these tips though to keep in budget!

This is great information. We are currently renting, but would like to buy another house in the next few years.