This post is for all the people out there who are serious about making their travel dreams happen. I’m going to show you how to save for a trip in 3 months!

As an aspiring traveler, there are probably plenty of places you want to visit someday.

While looking to fund your dream trip, you’ve realized by now that there are some necessary steps to keep in mind if you want to be successful at saving up for it.

Some of the steps you will need to commit to include saving up money, knowing how much a trip will cost, and developing responsible borrowing habits.

Following these steps will put you in a better position to be sure you will meet your goals and have the necessary funding for your ideal vacation.

Research the Costs Involved

The first step in saving up for your dream trip is knowing how much it will cost.

All vacations cost a considerable amount of money, so it’s in your best interest to determine how much you will need to spend to go on the vacation.

If funds are really tight, start by choosing a budget-friendly destination, if possible.

Some of the costs you will need to keep in mind include airfare, hotel accommodations, transportation, food, admission to some events and sights, and funding for souvenirs.

By writing out and knowing all the costs of a trip, you can begin the next step in the process: save up money.

Start Saving Money Early and Often

The next step in preparing for your dream vacation is to save up your money.

It will be important to set aside a certain amount of money each month to ensure that you have sufficient funds for your trip.

When it comes to saving money, it is a good idea to limit your expenditures to just ordinary and necessary living expenses for the entire 3 months.

It is a good idea to focus on putting your savings money in a separate account (like a dedicated savings account) so that you don’t accidentally spend it on everyday things.

Importance of Responsible Borrowing

While coming up with cash for a trip is ideal, some people decide to finance a trip with a credit card.

While it can certainly be done, be careful when choosing this route.

Using a credit card can make it very convenient to pay for things such as trips since you don’t need any cash upfront.

However, it’s vital to develop responsible borrowing habits before and after you go on the trip so that you don’t create aa financial burden you may regret later.

One of the best ways to establish good borrowing habits is to practice responsible credit line app use.

By borrowing money on credit lines responsibly, you will have the ability to extend your credit line and avoid financial difficulties in the future.

Set a Budget (and Stick to it!)

Anytime you plan on a dream trip, it is good to set up a budget to help you meet your savings goal.

This is basically a financial worksheet in which you record what you are making and spending.

With this information, you will then be able to make progress towards saving money because you will have a good overall picture of your finances.

Once you know your income and expenses, you can set aside some leftover cash for your trip.

While it may seem tedious to keep track of things so closely, setting up a budget is one of the most effective ways to save up for your next vacation.

Try a 30 Day Savings Challenge

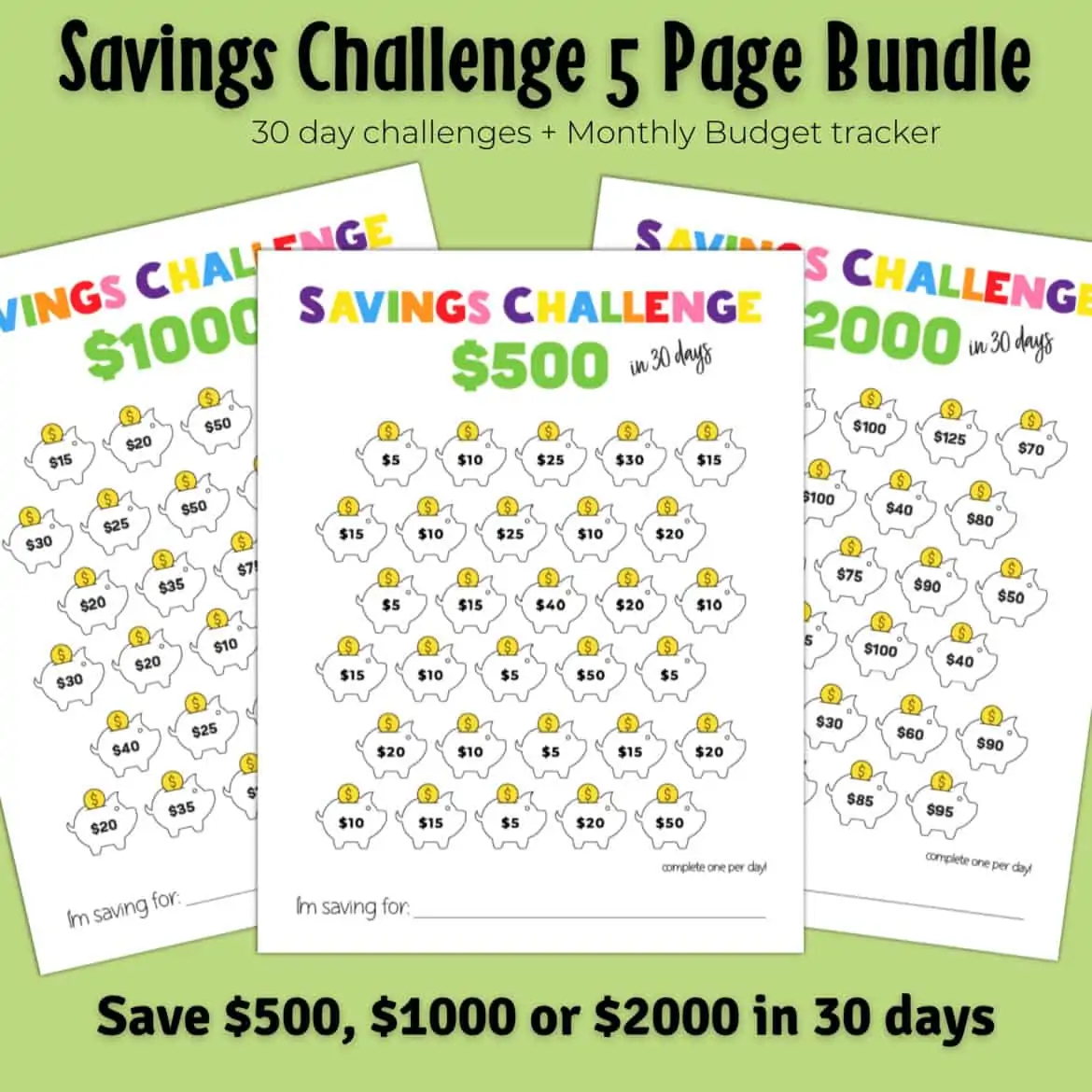

What is the 30 Day Savings Challenge? A 30 day money saving challenge is when you set a goal to save a certain amount of money in 30 days.

It’s referred to as a challenge because you may need to sacrifice things like going out one weekend or skip grabbing that cup of coffee every morning for a week.

But if you need an easy way to save money in a hurry, this is for you.

One of the reasons people are able to successfully complete this savings challenge is that it’s fairly flexible on how much money you need to save per day.

The varied amounts make it almost fun and you can feel accomplished when crossing off those big dollar amount days, while still knowing you’re on track even on small save days.

Whatever your reason for wanting to save $500, $1000 or $2000 (or any combination of them), it will always be easier to be successful at your money saving goals if you have a clear plan to follow.

If you want to save for 3 months, simply use the combination that matches your savings goal.

For instance, if you wanted to save $3,000, you could use the $1,000 challenge three times.

Or try a pyramid where you start with $500 for the first month, get after it with $2,000 for the second month and go back down to easy street at $500 again for the 3rd month.

30 Day Savings Challenge Printables

Our printable savings challenge bundle includes 3 different 30 day savings goal amounts ($500, $1,000 or $2,000) where you save one piggy bank amount per day, for 30 days.

You can save your money in a savings bank account, put it in an envelope, or just stick it in the freezer. Whatever works for you.

The best part is, you don’t have to do them in order. You can choose any amount to cross off on any day, just make sure you crossing off one per day. No cheating!

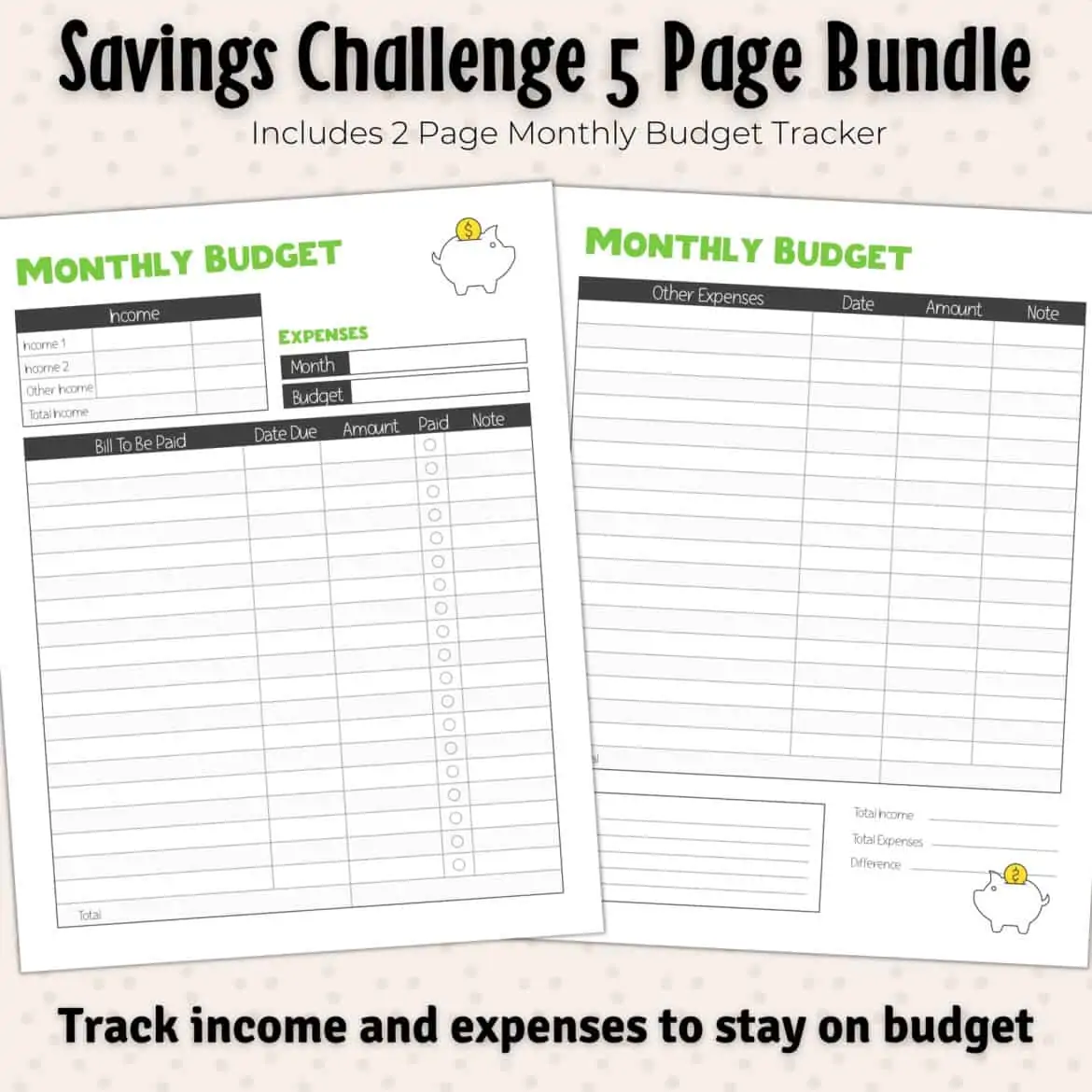

As a special bonus, our bundle also includes a Monthly Budget printable that will help you to keep track of your income and expenses.

If you’ve never taken the time to write these down before, you may be in for a real surprise at how much money you waste every month on things you really don’t need.

Most times you’ll end up finding ways to cut out things you don’t need for GOOD, which means more money in your pocket for future months and future dream trips!

Sacrifice Luxuries

While saving up for your next trip, one of the most important things you will have to do is sacrifice some luxuries for a while.

You may have to cut back on dining out, going to the movies, and spending money on clothes and gadgets.

By sacrificing some luxuries in your daily life, you will have extra money to put towards your vacation.

As a result, the more you can “do without”, the sooner you will be able to come up with sufficient funds for your dream trip.

How to Save for a Trip in 3 Months

Following these tips will hopefully help ensure that you take the necessary steps to reach your funding goals for your ideal dream vacation.

With some discipline and time, you will have the budget available to cover the costs of a vacation and make it a memorable one.

So in summary, remember that if you are looking to save money for your ideal trip, you want to:

- find out the costs of the trip

- focus on setting a budget

- only buy what you absolutely need

- and borrow money responsibly.